- Fox Point man sentenced to two years for $2.5M investment fraud scheme

- Hsiao Ching Tang, Managing Director at Azalea Investment Management, on democratization of private assets in Asia Pacific

- New Mexico’s oil income investments now surpass personal income tax revenue | OUT WEST ROUNDUP | News

- Marvell, Broadcom, Astera, Advanced Micro Devices and Semiconductor ETF

- Why Performance Chasing Is an Investing Error

MEDINA, Ohio – Following the passage of the 7.5 mill levy last fall, officials within Medina City Schools have vowed to closely watch the district’s budget by reducing expenditures and looking for alternative sources of income.

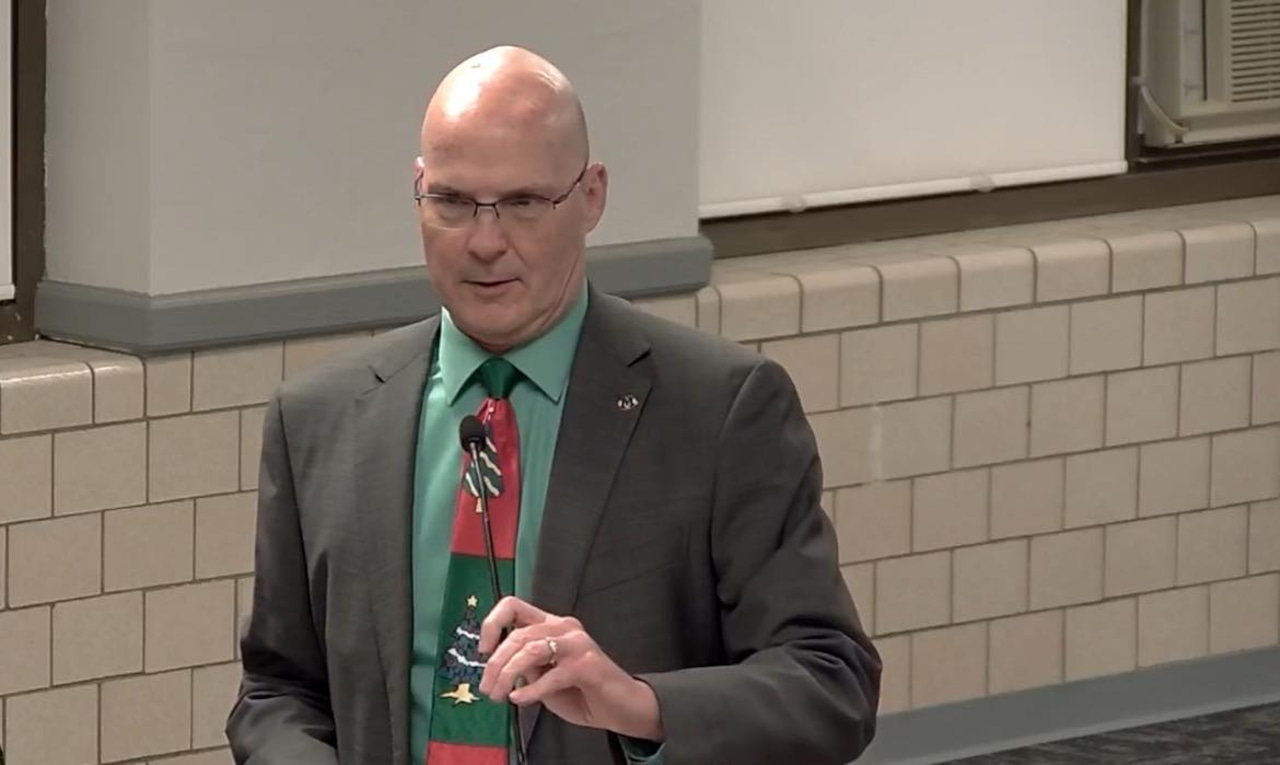

You are viewing: Medina treasurer explains benefits, limits of investment income

Treasurer David Chambers recently explained that over the last fiscal year, the district received roughly $24 million from local tax revenue and $7.5 million in state funding.

See more : Sonos Inc (NASDAQ:SONO): A Bullish Investment Perspective

“When we talk about state funding, we are always looking at a changing number,” Chambers said during a recent board of education meeting. “When valuations go out to the state, the state will reevaluate the amount it contributes.”

Chambers said he expects the state’s contribution to Medina City Schools will be less this year than it was last year.

Superintendent Aaron Sable said that Chambers has been very diligent when it comes to obtaining investment income for the school district.

See more : Bond Forecast: Pros See 10-year Treasury Yield Falling Modestly In 2025

Chambers said that the amount of investment income the district receives is up by about $132,000 compared to last year, but added that while the additional revenue helps, the income source is very limited. He said last year was the largest amount the district took in from investment income – roughly $1.6 million.

“That $1.6 million was able to offset almost a mill of levy revenue that we would have had to otherwise ask for,” Chambers said.

Chambers said there are very strict rules about the types of investments school districts are allowed to make. Acceptable investments include CDs, treasuries, municipal bonds and commercial paper.

“It is required that they be as risk free as you can get,” he said. “We can’t play the stock market or purchase bonds under a double A rating. These are very conservative investments.”

Source: https://magnacumlaude.store

Category: News