The billionaire Amazon founder put early money into Airbnb and Uber. Now he’s placing bets on these AI robotics companies.

By Phoebe Liu, Forbes Staff

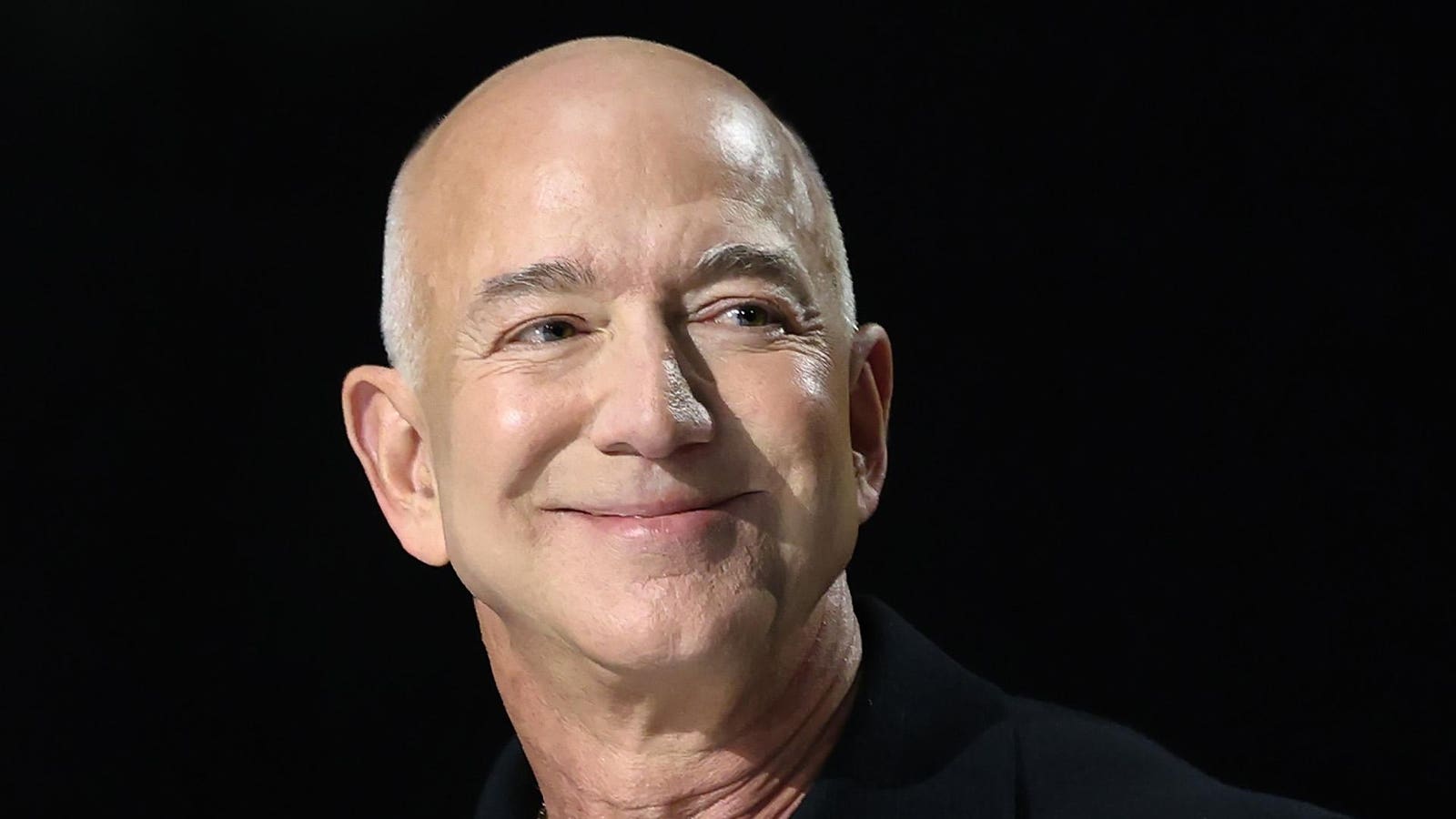

Before Marko Bjelonic, cofounder and CEO of AI robotics company Swiss-Mile, met with billionaire Jeff Bezos last April, he sent Bezos his version of an Amazon 6-Pager to pitch his company, hoping it would improve his odds in a video call he expected to feel rushed—but wasn’t. (The 6-Pager is the now-famous document that Bezos required Amazon executives to circulate before strategic meetings in lieu of PowerPoint slides and is known as a key element of Amazon’s culture.) “I was very surprised by how patient he was and how relaxed,” Bjelonic says. The call was scheduled for 30 minutes, but ended up being an hour long. “It felt like a conversation.”

You are viewing: Inside Jeff Bezos’ Personal Investments

That call led Bezos to co-lead a $22 million funding round in Zurich-based Swiss-Mile in August. The company is developing AI-powered robots that look a bit like wiry, headless dogs with wheels for feet and, later this year, can hopefully deliver items from point to point. It’s currently testing early versions on the streets of Zurich.

Swiss-Mile is one of at least nine companies that got investments from the world’s second richest person in 2024; seven of them are artificial intelligence startups, according to media reports, PitchBook and Preqin data and Forbes research. A representative for Bezos wouldn’t comment. Four of the startups, including Figure AI and Swiss-Mile, are specifically working on AI-powered robotics—a vertical he had not publicly focused on as a venture investor before last year.

Swiss-Mile, a startup that spun out of Swiss university ETH Zurich in 2023, makes autonomous robots that can open doors and handle packages. Bezos invested in the company in August 2024.

Swiss-Mile

While Bezos wouldn’t comment on his investment strategy, billionaire entrepreneurs who typically dip into angel investing are seeing changes coming. In this case, Bezos may think AI-powered robotics is on the cusp of a big commercial breakthrough. “They want to be on the forefront of investing into the type of technology that can be beneficial for their industry,” says Kjartan Rist, founding partner at Concentric, a venture firm that only has family offices as limited partners. “They’ve seen the waves that have come. So they’re very keen on being part of the next wave.”

For Bezos, the last couple of “waves” in his primary industry—ecommerce—were likely real estate for distribution centers and robotics, and the next wave is autonomous robotics, Rist added.

See more : EAAIF backs Vietnam’s CME Solar in second Asia investment

Bezos isn’t new to robotics; in 2007 he made an early bet on Rethink Robotics, a startup that helped robots automate manufacturing. During Bezos’ tenure as CEO of Amazon, the company purchased several robotics companies, including Kiva Systems in 2012 and Canvas Technology in 2019. But Bezos has never publicly invested in so many robotics startups in a year, and autonomous robots, which can operate without direct human supervision, are new.

Two of the four AI robot companies (Figure AI and Physical Intelligence) didn’t respond to a request for comment, but Swiss-Mile’s Bjelonic and Skild AI cofounder and CEO Deepak Pathak are of course bullish, believing it’s a breakthrough moment for AI-powered robotics: “As people get interested about building artificial general intelligence, … robotics is the way to go to AGI,” Pathak says. “This is the next big frontier for AI.”

Bjelonic likens it more to the invention of the iPhone, saying that all the requisite technologies are coming together to make autonomous robots possible—AI advances so the robots can be smarter, and cheaper hardware so more people can build them.

From a more practical perspective, robots have countless business use cases. They could eventually do dangerous jobs that fewer and fewer people are willing to risk their lives for, like mining—but the next step is to put them in “semi-structured” environments alongside humans, like hospitals and warehouses, according to Pathak. Bjelonic says he spoke with Bezos about limiting Swiss-Mile’s efforts to delivery—Amazon’s bread-and-butter—for now, something he says Bezos likened to his decision to focus Amazon on selling books before expanding to other products.

Additionally, even though Bezos isn’t involved in Amazon day-to-day, his 9% stake in Amazon still accounts for most of his fortune. As such, companies that benefit Amazon would also benefit Bezos financially. Amazon’s corporate venture capital arm also invested in Figure AI, Swiss-Mile and Skild AI, which makes sense given that Amazon is one of the world’s largest employers of robots, having deployed 750,000 of them to date. (Bjelonic and Pathak declined to comment on whether their technology is or will be used in Amazon warehouses.)

Beyond robotics, Bezos backed two buzzy companies last year: controversial AI-powered search engine Perplexity AI (Dow Jones & Co. sued the company in October alleging large-scale illegal copying of copyrighted work; Forbes sent Perplexity a cease-and-desist letter accusing the company of using its reporting without permission in June), and chip designer Tenstorrent, which aims to compete with chip giant Nvidia. In addition, the Amazon founder put money into fintech firm Outgo and caregiver support firm Magnolia.

Bezos has personally invested in at least 108 startups across all industries since he was reported to have first put $250,000 into Google in 1998. Although he doesn’t disclose his returns (nor do the companies in which he invests), he’s placed early bets on several companies that ended up launching some of the last decade’s splashiest tech IPOs, including Twitter (which he backed in 2008), Airbnb (reportedly in 2009), Uber (in 2012) and Nextdoor (reportedly in 2013).

He certainly has plenty of cash to play with: Bezos has sold some $32 billion worth of Amazon shares since the company went public, including nearly $14 billion last year, Forbes calculates. He is now the world’s second richest person, worth $241 billion.

And although Bezos has spent ample time and money on yachts, jets and glitzy real estate since shifting from CEO to chairman of Amazon in 2021, he’s still personally involved in his venture portfolio, helping select investments and advising portfolio companies. Still, Bezos isn’t as involved as, say, the typical big venture capital firm: he’s not known to hold a board seat at any of the startups he’s backed, and was only the lead investor in one funding round last year (for Swiss-Mile), meaning he likely didn’t pick up large stakes in most of the companies.

Two of the companies Forbes contacted said that a spokesperson for Bezos requested that they not engage with the media about Bezos’ investment, but those who would comment spoke favorably about Bezos’ involvement.

“What I was most surprised with was actually how well he understood the technology behind the AI training. He would ask questions about reinforcement learning, imitation learning, how it works, going all the way to the details of the physics elements that are needed on our side,” Swiss-Mile’s Bjelonic said, adding that he thinks Bezos makes the final investment decisions. (For Swiss-Mile, Belonic added, his decision took “a few weeks.”) Pathak declined to comment on the specifics but described having a “very close relationship with [Bezos Expeditions], and with Jeff directly.”

Regardless of how involved Bezos is in any given company, publicizing his name as one of the investors provides marketing exposure (in the words of Columbia Business School professor Michael Ewens, “Bezos is in, do you want in too?”) and credibility: two crucial assets for young, capital-intensive startups.

For now, the autonomous robotics industry is still in its early commercial days. Bjelonic likened the market to a “blue ocean,” guessing that in ten years, there could be hundreds of robotics companies that have failed, but a handful that succeed. It will take years to know if those bets pay off.

But the odds may be in Bezos’ favor, in part because he can combine his business acumen with the fact that he likely gets his pick of any company he wants to invest in. The “best” and “hottest” companies call people like Bezos first, says Ewens. “In general, he’s a very good investor, because he’s getting calls. He’s first in line.”

MORE FROM FORBES

Source: https://magnacumlaude.store

Category: News