Investment consortia and PV companies from China, Japan and India have ventured into the Middle East market one after another. In particular, Chinese PV companies have undergone essential changes in their cooperation mode and scale, shifting from a single business model of selling products into the Middle Eastern market to now investing in and building factories in the region covering the whole polysilicon-to-module PV value chain.

You are viewing: Chinese PV players fuel Middle East investment boom

According to data from Chinese customs, from 2022 to 2023, China’s PV module exports to the Middle East and North Africa have consecutively exceeded 10GW. Among them, Saudi Arabia and the United Arab Emirates have seen rapid growth in shipments. Taking Saudi Arabia as an example, China’s PV module exports to the country reached US$1.34 billion in 2023, making Saudi Arabia the sixth largest importer of China modules.

On the other hand, with the further tightening of the United States’ antidumping investigation and supervision of the four Southeast Asian countries, Southeast Asia is no longer the first choice for Chinese PV companies to build plants overseas. Instead, the trend is towards globalised manufacturing and investment to find more suitable overseas production bases and investment bases. In this context, the Middle East is becoming a new hot spot for PV companies to invest.

Chinese companies flocking to invest in the Middle East, covering the entire PV industry chain

According to incomplete statistics gathered by the author, Chinese PV companies such as Jinko Solar, Trina Solar, Sungrow, TCL Zhonghuan, GCL-Tech, Drinda (Jietai solar), Arctech Solar and ANTAI Solar have announced investment plans in the Middle East, involving a huge amount of money and covering the industry chain including polysilicon, wafers, cells, modules, trackers, inverters and integration projects (as shown in Table 1).

In July 2024, Jinko Solar announced that its wholly owned subsidiary, Jinko Solar Middle East DMCC, entered into a shareholders’ agreement with Renewable Energy Localization Company (RELC), a subsidiary of the Public Investment Fund of the Kingdom of Saudi Arabia (PIF), and Vision Industries Company (Vision Industries), to establish a joint venture in Saudi Arabia to construct a 10GW high-efficiency cell and module project. The total project investment is approximately US$985 million.

Jinko Solar says the joint venture is expected to become the largest overseas manufacturing base for China’s PV cell and module industry when it is officially put into operation.

“Investing in the Saudi plant means that the company has shifted from a passive strategy to avoid trade barriers to active production planning,” Qian Jing, vice president of Jinko Solar, says in an interview. “Different from the previous practice of exporting capacity from our plants in Malaysia, Vietnam and the United States, the company has changed to export technology, system, experience, talent, supply chain and even corporate culture starting with the Saudi plant in the Middle East.

“Saudi Arabia is rich in capital, and they value our technical experience and our market share of more than 50% in the Middle East. The company currently needs low-cost financing to maintain its technological leadership.”

Of course, building a plant in the Middle East does not mean that there are no risks. As Li Xiande, chairman of Jinko Solar, the earliest Chinese PV company in this field, points out: “The biggest risk comes from the long-arm jurisdiction of the United States.”

Judging from the current capacity layout of Chinese PV companies in the Middle East, as summarised in Table 1, a certain cluster effect is evident, and one of their ultimate target markets is still the United States. The tariff policy of the United States will continue to change, particularly after the re-election of Donald Trump in the recent presidential election. In the long run, will there be a further double bill of antidumping and countervailing measures as placed on Southeast Asian PV products by the USA? How should Chinese PV companies face and balance this issue?

In response to this, Li Xiande references a ‘4-3-3’ cooperation model proposed by Zeng Yuqun, chairmain of the battery manufacturer CATL. This uses the analogy of the 4-3-3 formation in football to describe how companies expanding internationally should follow a 4:3:3 ratio of technology, raw materials and market.

“We may think that it is unreasonable to sell cheap, high-quality products to the international market and still encounter trade barriers. However, these regions or countries also need to solve employment problems and economic development problems, so that there will be a three-way scramble for the supply chains in technology, raw materials and markets. How to resolve this contradiction? It is a good idea to cooperate with the three parties who have technology, raw materials and markets in a ratio of 4:3:3.”

It is noted that in the “Saudi Arabia 10GW PV cell and module capacity” project, Jinko Solar is adopting a cooperation model similar to 4-3-3, as the “technology party”, in partnership with “the resource party” (PIF’s wholly owned subsidiary RELC) and the “market party” (Vision Industries)”, holding 40%, 40%, and 20% equity of the joint venture respectively.

In fact, as early as 2011, Li Xiande, who experienced earlier trade measures imposed by Europe and the United States against Chinese PV imports, proposed that Jinko should achieve the “globalisation trilogy” from global sales to global manufacturing and global investment. Since then, Jinko has established its first GW-scale overseas plant in Penang, Malaysia at the end of 2015. The US plant and the vertical integration plant in Vietnam have been built successively in 2018 and 2021.

See more : Tether Announces $775 Million Strategic Investment in Rumble, Fuels Growth of Decentralized Media

This cooperation with PIF is the first time that Jinko Solar has relied on technology, experience, system and talent to deploy overseas capacity through a joint venture. There are a lot of adjustments in the new cooperation model, and Li Xiande said without hesitation: “We have gone through a very long and arduous negotiation with PIF, and there will be many challenges in the future.”

According to Jinko Solar’s mid-year report in 2024, in H1 of this year, the company’s market share reached 50% in the Middle East PV module market, in response to growing demand in the region.

In July 2024, TCL Zhonghuan announced a blockbuster investment plan. The project is also located in Saudi Arabia. It is interesting to note that the cooperation model is the same as that of Jinko.

TCL Zhonghuan announced that it intends to sign a shareholders’ agreement with Vision Industries and Renewable Energy Localization Company (“RELC”), a subsidiary of Saudi Arabia’s public investment fund PIF (“PIF”), to establish a joint venture to jointly build a 20GW wafer project in Saudi Arabia.

The wafer is the most technically complex segment in the PV industry chain. In this regard, TCL Zhonghuan said that as a leader in wafer, the company has advantages in technology, intelligent manufacturing and operation management. With national strategic functions and government resources, PIF is an important implementing agency of Saudi Arabia’s national economic strategic plan. Vision Industries is a leading investor and developer of Saudi green energy industry projects and local supply chains, boasting regional resources and localisation experience.

At the same time, Chinese PV tracker companies Arctech, Antai Solar and Zhenjiang New Energy are also actively exploring the Middle East market. Among them, Arctech has signed a land lease agreement with Saudi Arabia to build a PV tracker production base in Jeddah, with an estimated annual capacity of 3GW. Zhenjiang New Energy, meanwhile, has chosen to cooperate with an American PV tracking solution provider to invest in the construction of a PV tracker manufacturing plant in Saudi Arabia.

In addition to investment, many PV companies have also received large orders. On 15 July, Sungrow announced it had signed a contract with ALGIJAZ in Saudi Arabia for the world’s largest storage project with a capacity of up to 7.8GWh, setting a record for such projects.

Why the Middle East? Demand, policy and market potential

Before venturing into the Middle East, Chinese businessmen who went abroad had long been active in Europe and the United States, as these two markets have offered huge demand, a favourable business environment and higher product prices. However, trade barriers in the European and American markets have built up year by year, and the huge hidden dangers buried by the entry thresholds, such as “double anti” investigations, are always on the verge of exploding. Many Chinese PV companies have suffered heavy losses, forcing them to look for safer markets.

In terms of the current choices of Chinese PV companies, Saudi Arabia, the United Arab Emirates and Oman have become popular investment destinations in this round of investment.

From a geographical perspective, countries such as Saudi Arabia, UAE and Oman are close to Europe and are located at the junction of Asia, Europe and Africa. For Chinese companies that are in urgent need of globalisation and are constrained by trade barriers in Europe and the United States, the Middle East is a good launchpad for going global. The capacity invested in the Middle East can be easily re-exported to markets such as Europe and the United States.

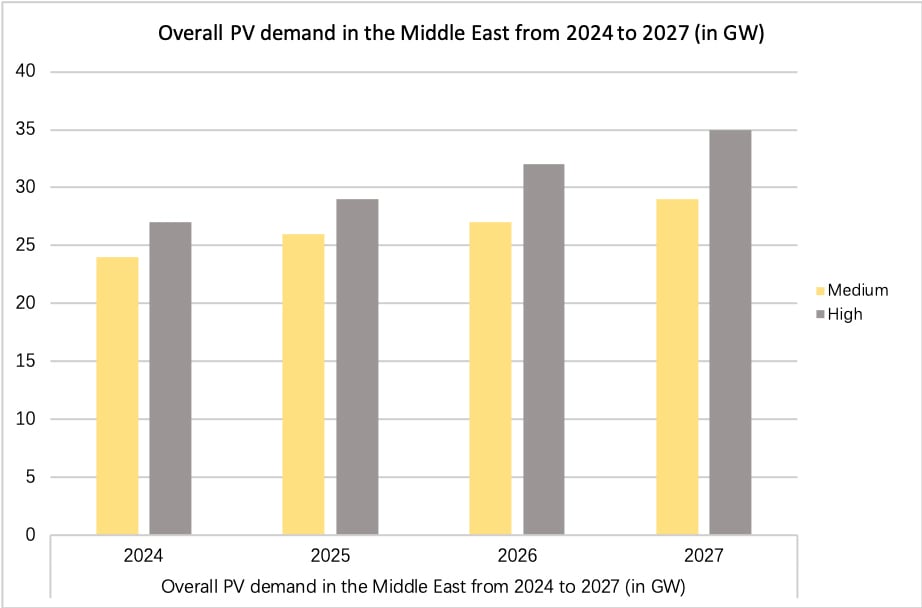

At the same time, the PV market in the Middle East has strong growth potential. Analysis firm InfoLinkConsulting predicts that PV demand in the Middle East will reach 29-35GW in 2027.

GlobalData, a global data analysis and consulting firm, expects that Saudi renewable generation capacity will grow at a CAGR of 40.1% between 2023 and 2030.

Saudi Arabia is also one of the earliest countries in the Middle East to develop renewable energy. In 2016, Saudi Arabia officially released Saudi Arabia Vision 2030, which aims to diversify its economy and transform its energy structure to drive stable and sustained economic growth. Saudi Arabia plans to increase the share of natural gas and renewable energy to about 50% by 2030, while reducing the use of liquid fuels.

Saudi Arabia has accelerated its renewable energy programme in recent years. At the Future Energy Summit hosted by Saudi Arabia in 2021, the country launched two new initiatives. One is the “Green Saudi Arabia”, which aims to invest about US$266 billion in clean energy production and commits to reducing carbon emissions by 278 million tons per year by 2030. The second is the “Green Middle East Initiative”, which aims to pool the efforts of Middle Eastern countries to reduce global carbon emissions by about 10%.

Meanwhile, the “Energy Strategy 2050” released by the United Arab Emirates shows that it will increase the proportion of clean energy to 50% by 2050. It even plans to achieve net-zero greenhouse gas emissions by 2050.

See more : State to study return on investment of Women/Gender Studies programs • Florida Phoenix

For Chinese enterprises, the advantages of investing in the UAE include, first, friendly foreign investment policies and a relaxed financial environment; second, close geographical location to Europe; third, many European countries have free trade agreements, which offer significant tax advantages; fourth, sufficient basic labour force, which is a great benefit for labour-intensive industries; fifth, cheap energy.

Trina Solar chose the UAE, announcing in October 2023 plans to invest in the construction of a large vertically integrated project in the Khalifa Economic Zone in the UAE, covering the entire PV value chain, from silicon materials to modules. The planned capacity consists of about 50,000 tons of high-purity silicon materials, 30GW of wafers and 5GW of modules. The project will be built in three phases.

According to the announcement, Trina Solar has also adopted a cooperation mode, with partners including AD Ports Company PJSC and Jiangsu Province Overseas Cooperation Investment Co., Ltd.

In addition, there is GCL-Tech, which has shifted from Saudi Arabia to the U.A.E. On 3 June 2024, GCL-Tech announced that its first overseas FBR granular silicon project is expected to land in the UAE, becoming the world’s largest granular silicon R&D and manufacturing base outside China.

According to the announcement, a wholly owned subsidiary of GCL-Tech, GCL-Tech (Suzhou) Co., Ltd., signed a cooperation agreement with MDCPOWER HOLDING COMPANY LLC, a wholly owned subsidiary of MUBADALA, to jointly explore the possibility of establishing an integrated silicon ecosystem in the UAE.

Industry speculation is that GCL-Tech’s final choice to build a plant in the UAE is likely to be related to the special power prices provided by the UAE and more favourable financing conditions.

There are only a limited number of countries in the Middle East that have the conditions to establish polysilicon production bases, mainly the UAE, Saudi Arabia and Oman. These countries all have a certain industrial base, controllable power costs and a relatively stable social order.

Oman has also proposed Vision 2040, which intends to accelerate the investment and promotion of renewable energy and green hydrogen projects. To this end, Oman has also attracted the entry of several companies, such as Drinda (Jietai Solar) and Qsun-PV.

On 13 June 2024, Drinda, which produces cells through Jietai Solar, and the Oman Investment Agency jointly signed an ‘investment intent agreement’. Under the agreement, Junda plans to build a 10GW TOPCon PV cell manufacturing plant in Oman. With an investment of approximately US$700 million, the 10GW capacity will be built in two phases of 5GW each.

Following up on 26 July, Drinda disclosed the latest progress of the first phase of the project, the 5GW highefficiency cell production base in Oman. It is reported that the production base is located in the Sultanate of Oman Sohar Free Trade Zone, backed with an estimated total investment of US$280 million, and is expected to be completed and put into operation by 2025.

Another Chinese PV company, Q-SUN Solar, along with Oman’s leading renewable energy company, Bakarat Investment, also announced in July that it would jointly build a PV equipment production base with a combined capacity of 10GW in Oman’s Sohar Free Trade Zone.

Specifically, the base will have a capacity of 8GW for advanced PV modules and 2GW for PV cells, covering TOPCon and heterojunction technologies.

Q-SUN Solar said that the reason why the company chose to invest in Oman is, first of all, that Oman has a number of large seaports facing the Indian Ocean, as well as rich human resources, a convenient business environment, vast land and sufficient solar energy resources. Secondly, Oman also has abundant oil and gas reserves, which provide a solid support for energy transition and renewable energy development.

Overall, the investment enthusiasm of Chinese PV companies has brought new momentum to the realisation of PV manufacturing and vision in the Middle East. On the other hand, the Middle Eastern countries have also released huge potential demand, creating a benign economic and trade environment.

According to data of China’s National Development and Reform Commission, the trade volume between China and the six Gulf Cooperation Council (GCC) countries reached US$286 billion in 2023, and China has become the largest trading partner of Saudi Arabia and the UAE, with the bilateral trade volume between China and Saudi Arabia exceeding US$100 billion US dollars for two consecutive years.

Source: https://magnacumlaude.store

Category: News