- Vivid Seats Inc. (NASDAQ:SEAT): A Bullish Investment Perspective

- Dogecoin vs Shiba Inu: Which Meme Coin Will Lead in 2025?

- Jefferies’ profit jumps on investment banking windfall

- Opus Crest Announces Increased Investments With Plans to Expand Services in 2025

- Western Digital (WDC) Is Considered a Good Investment by Brokers: Is That True?

(Bloomberg) — GIC Pte’s Chief Investment Officer Jeffrey Jaensubhakij plans to step down after almost three decades at the Singaporean firm, one of the world’s biggest sovereign wealth funds, according to people familiar with the matter.

You are viewing: GIC’s Investment Chief to Step Down From Singapore Wealth Fund

Most Read from Bloomberg

The departure of Jaensubhakij, 58, is the biggest leadership change at GIC since January 2017, when he was made group CIO and his predecessor Lim Chow Kiat became chief executive officer. Deputy Group CIO Bryan Yeo, 46, is expected to be promoted to the top investment role in April, two of the people said, asking not to be identified because the matter is private.

“GIC considers key appointments very carefully and will announce changes in a timely manner,” said a GIC spokesperson in an emailed statement.

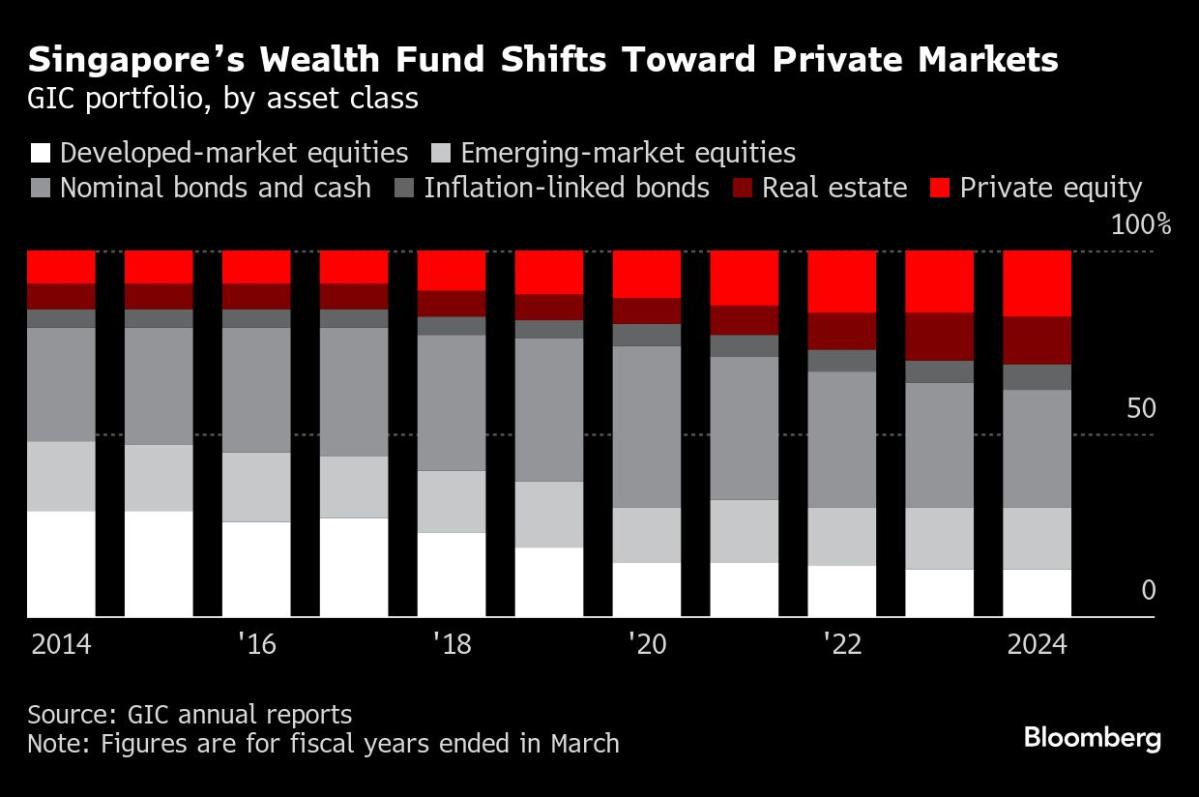

The change comes at a critical time for GIC as it ramps up private market investments and deals in the US amid expectations of further geopolitical instability and slowing returns. During Jaensubhakij’s tenure, the firm accelerated a strategy of investing in alternative assets such as unlisted companies and real estate and reducing reliance on stocks and bonds.

See more : Softbank woos Donald Trump $100 billion AI investment

That’s helped make the Singaporean firm one of the most powerful active investors in the world. While it doesn’t reveal its assets under management, GIC is estimated to oversee $800.8 billion, making it the seventh-largest sovereign wealth fund, according to the Sovereign Wealth Fund Institute.

Even so, returns have been steadily slowing in recent years. While its annualized returns for the five years ended March 2024 rose slightly from a year earlier to 4.4%, its 20-year annualized nominal return fell to 5.8%.

Jaensubhakij’s departure will mark the end of a near 30-year career at the firm, which has seen him run everything from North American equities to European operations and investments across the globe. He joined as a senior economist in 1998, having earned a Bachelor of Arts degree in economics from Cambridge University and a PhD. in economics from Stanford University.

Over that period the value of assets managed by GIC has soared, thanks to both performance and cash injections from the Singapore government. Assets under management have more than tripled from $247.5 billion in 2011, according to SWFI, while staff numbers have swelled from over 1,400 as of March 2017 to more than 2,300 last year.

Source: https://magnacumlaude.store

Category: News