- Horizon Aircraft secures $8.4 million investment

- Federal investment brings internet access to rural areas

- Sealed Air Corp (NYSE:SEE): A Bullish Investment Perspective

- OpenAI plans corporate restructure to attract investment

- Why it’s time to tweak your investments after lofty stock returns in 2024 – NBC10 Philadelphia

Elon Musk’s response to Scotland’s plea for a Tesla (TSLA) gigafactory paints a bleak picture for U.K. investments. After Alba Party’s Ash Regan urged Musk to establish a base similar to Tesla’s Berlin plant, Musk replied, “Very few companies will be willing to invest in the UK with the current administration,” highlighting ongoing concerns over the U.K.’s economic climate, including Brexit uncertainty.

You are viewing: Elon Musk Rejects Scotland’s Plea for Tesla Gigafactory Investment

Don’t Miss Our New Year’s Offers:

Musk Cites Brexit Risk and Government Policies

See more : Nvidia Just Redefined Retail Investing in 2024–And It’s Not Slowing Down

Musk’s hesitancy stems from the Brexit aftermath, which he previously cited as a risk factor when announcing Tesla’s Berlin gigafactory. Regan’s call for a gigafactory in Scotland had emphasized the region’s strategic location and potential for job creation. However, Musk has remained cautious about U.K. policies, including government decisions that, according to The Herald, have hindered industrial investment and economic growth.

Labour’s Approach Under Fire

Alba Party officials blame the Labour-led government for stifling growth through austerity measures and policies like increased National Insurance. The proposal for a gigafactory in Scotland, Regan argued, could create thousands of jobs, transforming the region’s manufacturing sector. However, with Musk’s critical stance on the U.K. government, it seems Scotland’s hopes for a Tesla factory may be dimming.

How Much Will Tesla Stock Be Worth in 2025?

See more : Survey: Experts Share The Top Overlooked Investment Themes To Focus On During 2025

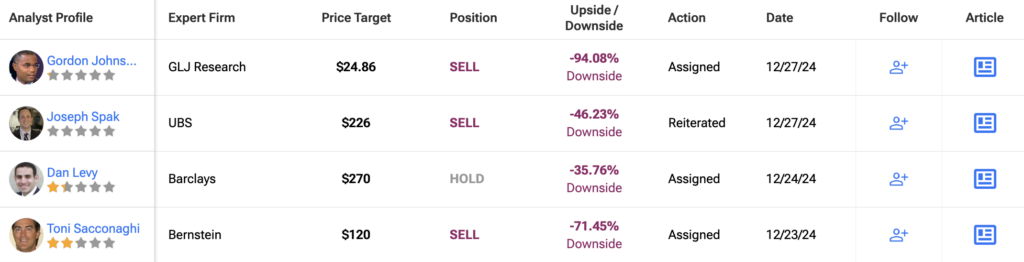

Analysts remain sidelined about TSLA stock, maintaining a Hold consensus rating from 13 Buys, 11 Holds, and nine Sells. While TSLA has skyrocketed by over 65% in the past year, the average 12-month TSLA price target of $294.30 suggests a potential downside of 29.7% from its current levels.

See more TSLA analyst ratings

Source: https://magnacumlaude.store

Category: News