- Most asset managers still rosy on sustainable investing

- Renewable energy investment continues under Trump, MUFG Americas says

- Connecticut’s time for energy investment is now – if state leaders get on board

- How Decentralized Finance Is Reshaping Investment

- Two-time USWNT gold medalist Lauren Holiday joins global soccer investment group Mercury/13

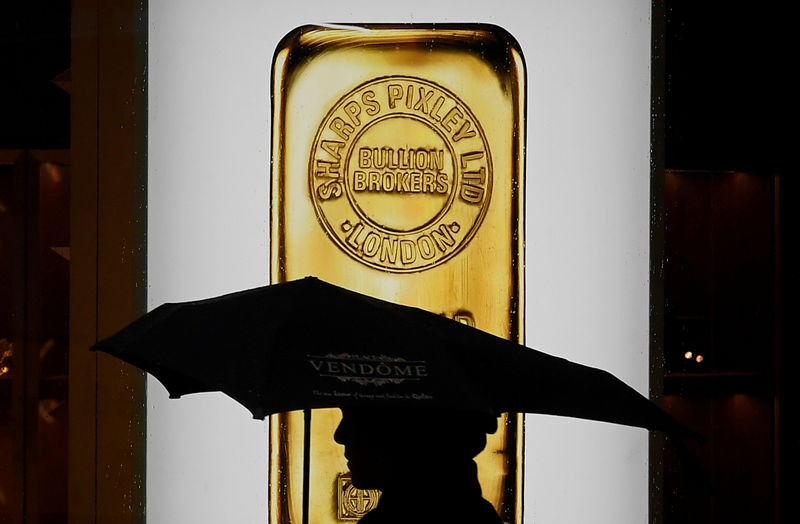

Investing.com– Gold prices were higher in Asian trade on Thursday due to a slightly weaker dollar as markets returned to trading after the Christmas holiday, while gains were limited as investors remained cautious following the U.S. Federal Reserve’s hawkish tilt.

You are viewing: Gold prices rise on slightly weaker dollar, geopolitical tensions By Investing.com

Traders also refrained from placing large bets in a holiday-shortened week, resulting in thin trade volumes.

rose 0.4% to $2,627.55 per ounce, while expiring in February ticked up 0.1% to $2,643.86 an ounce by 00:00 ET (05:00 GMT).

Geopolitical tensions in the Middle East also contributed to bullion’s gains.

The Palestinian militant group Hamas and Israel accused each other on Wednesday of hindering a ceasefire deal, with Hamas blaming Israel for imposing additional conditions and Israeli Prime Minister Benjamin Netanyahu alleging Hamas reneged on prior understandings.

See more : KULR Technology Makes Bold $21M Bitcoin Investment, Acquires 217 BTC at $96.5K Average

Gold is seen as a safe haven asset amid uncertainties in the market.

US dollar weakens but remains nears 2-yr high

The was slightly lower in Asian trade on Thursday but hovered near a two-year high it touched last week.

The Fed’s hawkish shift last week provided renewed strength to the dollar, as higher interest rates make the greenback more attractive due to increased returns on dollar-denominated assets.

A stronger dollar often weighs on gold prices as it makes the yellow metal more expensive for buyers using other currencies.

Gold prices fell sharply last week after the Fed policy meeting indicated that rates will remain higher for a longer period.

Higher interest rates put downward pressure on gold as, as the opportunity cost of holding gold increases, making it more attractive compared to interest-bearing assets like bonds

The yellow metal has seen marginal moves this week, after losing more than 1% in the previous week, reflecting uncertainty about the metal’s outlook

See more : Making the case for investment

Other precious were largely steady on Thursday. were unchanged at $960.20 an ounce, while were muted at $30.273 an ounce.

Copper edges up on China stimulus, strong dollar caps gains

Among industrial metals, prices inched higher after a Reuters report showed that Chinese authorities plan to issue a record-breaking 3 trillion yuan ($411 billion) in special treasury bonds next year, in an intensified fiscal effort to stimulate a struggling economy.

The red metal failed to fully capitalize on this news, as a strong dollar weighed.

Analysts also attributed the weakness in copper to seasonal sluggishness as industrial production and construction projects often slow down as businesses and projects prepare for year-end closures and holidays.

The most-traded January copper contract on the Shanghai Futures Exchange (SHFE) rose 0.2% to 74,220 yuan a ton.

Benchmark copper contracts on the London Metal Exchange were closed on Thursday for the holiday.

Source: https://magnacumlaude.store

Category: News